A. INFLATION RATES FOR ALL ITEMS

Headline Inflation

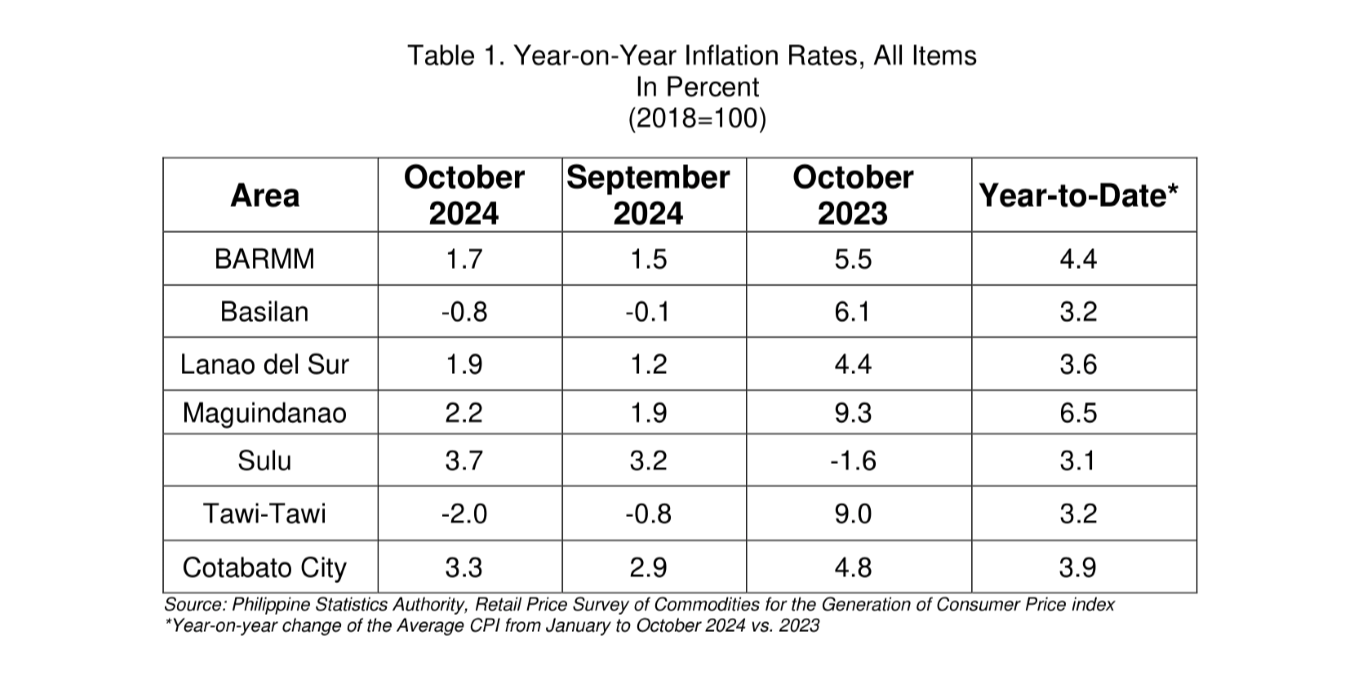

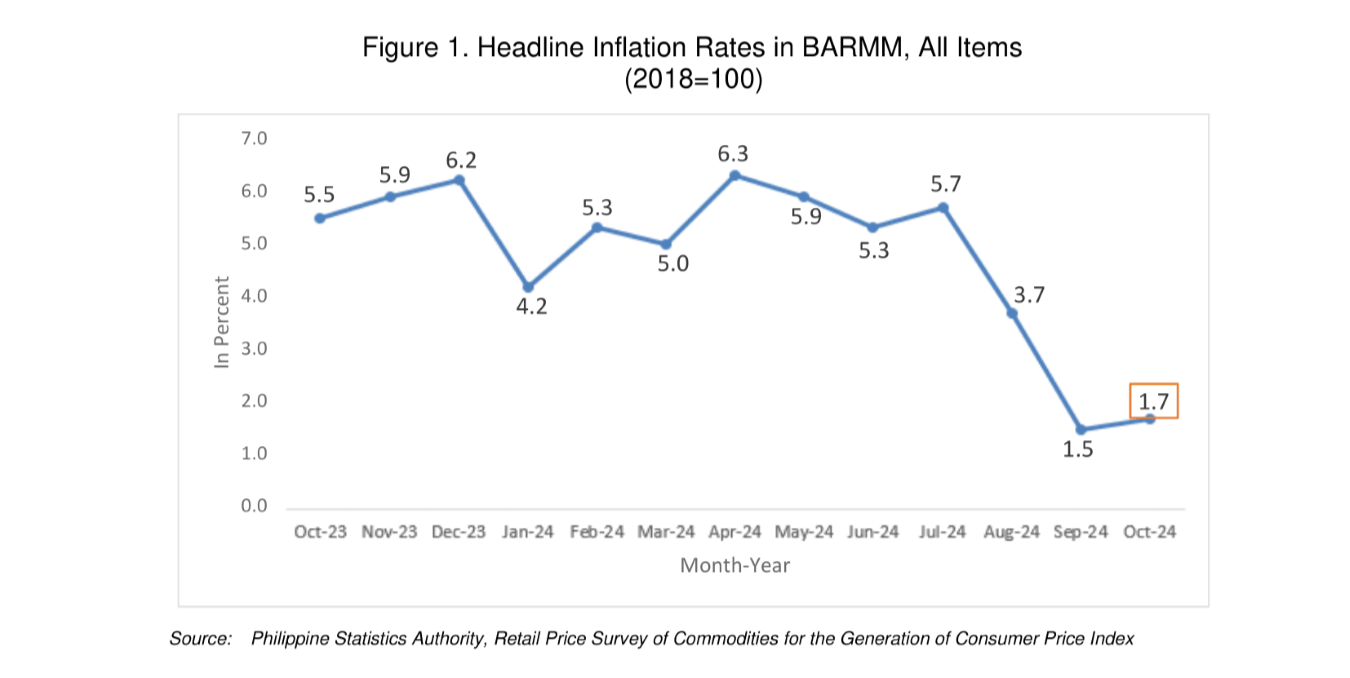

The headline inflation in BARMM accelerated to 1.7 percent in October 2024 from 1.5 percent in September 2024. This brings the regional average inflation from January to October 2024 to 4.4 percent. In comparison, the inflation rate in October 2023 was higher at 5.5 percent. Basilan and Tawi-Tawi showed lower inflation rates compared to their previous month’s rates. While Lanao del Sur, Maguindanao, Sulu and Cotabato City, an Independent Component City (ICC), posted higher inflation rate than their previous month’s rates. (See Table 1 and Figure 1)

Main Drivers to the Downward Trend of the Headline Inflation

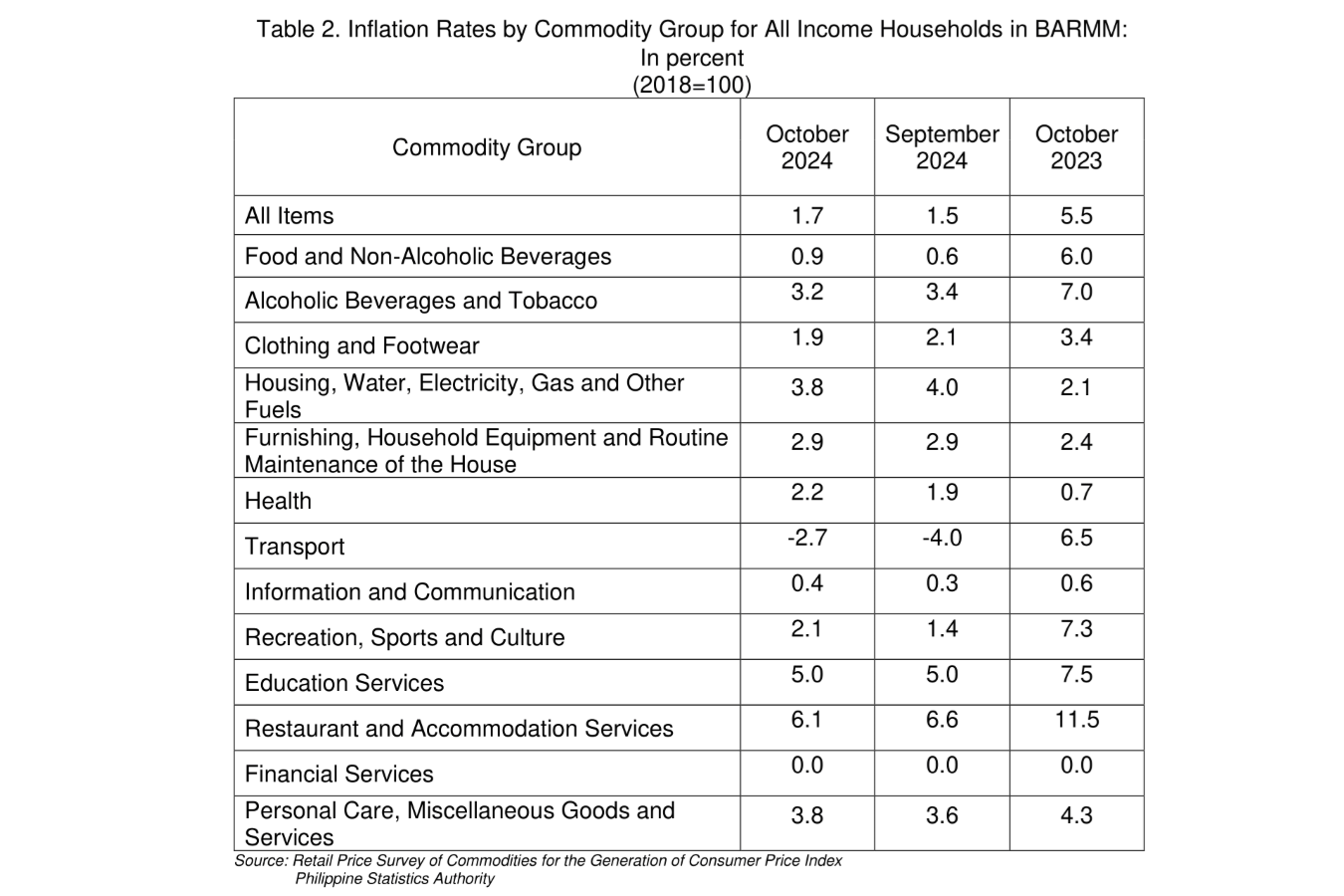

The increase in overall inflation in BARMM in October 2024 was primarily driven by the faster annual increase in the index for food and non-alcoholic beverages, which grew to 0.9 percent in October 2024 from 0.6 percent in the previous month. Another contributor to the growth was the transport with a slower year-on-year decrease of 2.7 percent during the month from a 4.0 percent annual drop in September 2024. Additionally, a higher inflation rate was recorded for personal care, and miscellaneous goods and services which increased to 3.8 percent in October 2024 from 3.6 percent in September 2024.

The following commodity groups also recorded increase in their inflation rates compared to the previous month:

a. Health, 2.2 percent from 1.9 percent;

b. Information and communication, 0.4 percent from 0.3 percent;

c. Recreation, Sport and culture, 2.1 percent from 1.4 percent.

Meanwhile, the following commodity group shows lower inflation rate in October 2024:

a. Alcoholic Beverages and Tobacco, 3.2 percent from 3.4 percent;

b. Clothing and Footwear, 1.9 percent from 2.1 percent;

c. Housing, Water, Electricity, Gas and Other Fuels 3.8 percent from 4.0 percent; and

d. Restaurants and accommodation services, 6.1 percent from 6.6 percent.

On the other hand, indices of furnishing, household equipment, routine and maintenance of the house, financial and education services remain constant at its September 2024 inflation rates. (Table 2)

B. INFLATION RATES FOR FOOD ITEMS

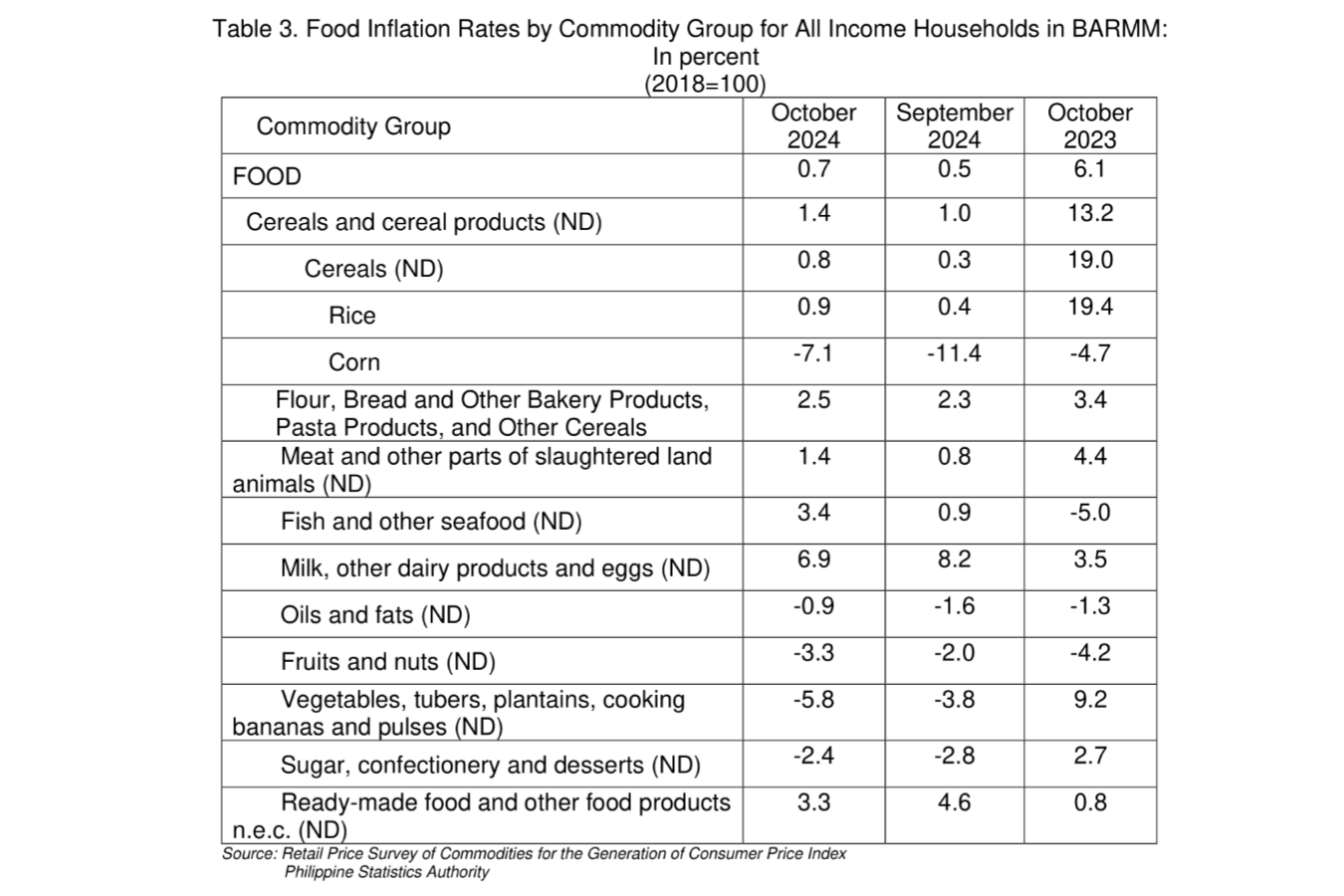

For food commodities, inflation increased to 0.7 percent in October 2024 from 0.5 percent in the previous month. In October 2023, inflation of food items was higher at 6.1 percent. (Table 3)

The increase in the region's food inflation was primarily driven by the higher index for

fish and other seafood which increased to 3.4 percent in October 2024 from 0.9 percent from the previous month. This was followed by the year-on-year growth in cereals and cereal products, which has a growth by 1.4 percent during the month, compared to a 1.0 percent in September 2024. Additionally, the index for meat and other parts of slaughtered land animals increased to 1.4 percent in October, from 0.8 percent in September 2024.

The following food groups also recorded increase in their inflation rates compared to the previous month:

a. Rice, 0.9 percent from 0.4 percent;

b. Corn, -7.1 percent from -11.4 percent;

c. Flour, bread and other bakery products, pasta products, and other cereals, 2.5 percent from 2.3 percent;

d. Oils and fats, -0.9 percent from -1.6 percent; and

e. Sugar, confectionery and desserts, -2.4 percent from -2.8 percent

Conversely, the food group comprising the following recorded lower inflation rates in October 2024 compared to the previous month:

a. Milk, other dairy products, and eggs, 6.9 percent from 8.2 percent;

b. Fruits and nuts; -3.3 percent from -2.0 percent;

c. Vegetables, tubers, cooking bananas and pulses, -5.8 percent from -3.8 percent; and

d. Ready-Made food and other food products, 3.3 percent from 4.6 percent.

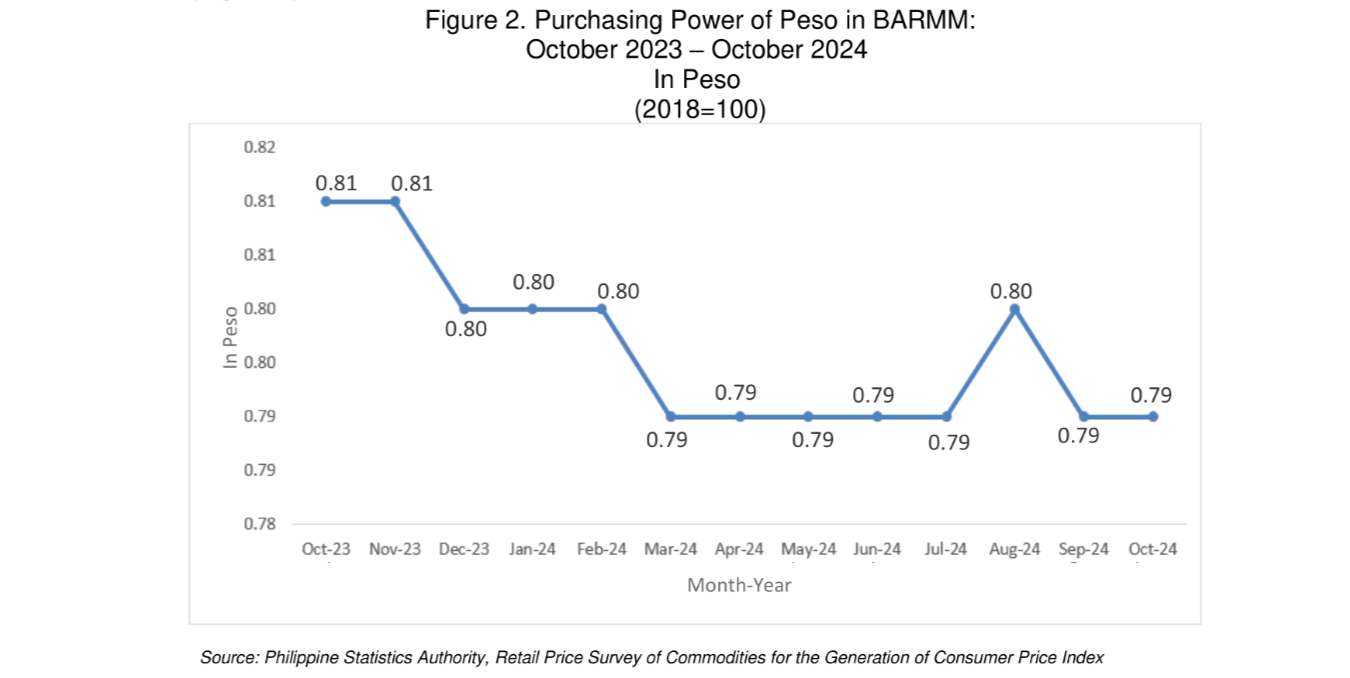

C. PURCHASING POWER OF PESO

In BARMM, the Purchasing Power of the Peso (PPP) is at PhP 0.79 as of October 2024. (Figure 2)

TECHNICAL NOTES:

Consumer Price Index (CPI)

The CPI is an indicator of the changes in the average retail prices of a fixed basket of goods and services commonly purchased by households relative to a base year.

Uses of CPI

The CPI is most widely used in the calculation of the inflation rate and purchasing power of peso. It is a major statistical series used for economic analysis and as a monitoring indicator of government economic policy.

Computation of CPI

The computation of the CPI involves consideration of the following important points:

a. Base Period

The reference date or base period is the benchmark or reference date or period at which the index is taken as equal to 100.

b. Market Basket

A sample of the thousands of varieties of goods purchased for consumption and services availed by the households in the country selected to represent the composite price behavior of all goods and services purchased by consumers.

c. Weighting System

The weighting pattern uses the expenditures on various consumer items purchased by households as a proportion to total expenditure.

d. Formula

The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the Laspeyre’s formula with a fixed base year period (2018) weight.

e. Geographic Coverage

CPI values are computed at the national, regional, and provincial levels, and for selected cities.

Inflation Rate

the rate of change of the CPI expressed in percent. Inflation is interpreted in terms of the declining purchasing power of the peso.

Headline Inflation

refers to the rate of change in the CPI, a measure of the average standard “basket” of goods and services consumed by a typical family.

Purchasing Power of Peso

shows how much the peso in the base period is worth in the current period. It is computed as the reciprocal of the CPI for the period under review multiplied by 100.

Note: The dataset used in the special release is exclusive for BARMM provinces including Cotabato City and excluding Special Geographic Area (SGA).

Approved for release:

ENGR. AKAN G. TULA

OIC-Regional Director